With experience and an innovative culture, we enable creative solutions for highly complex RF challenges

Investor relations

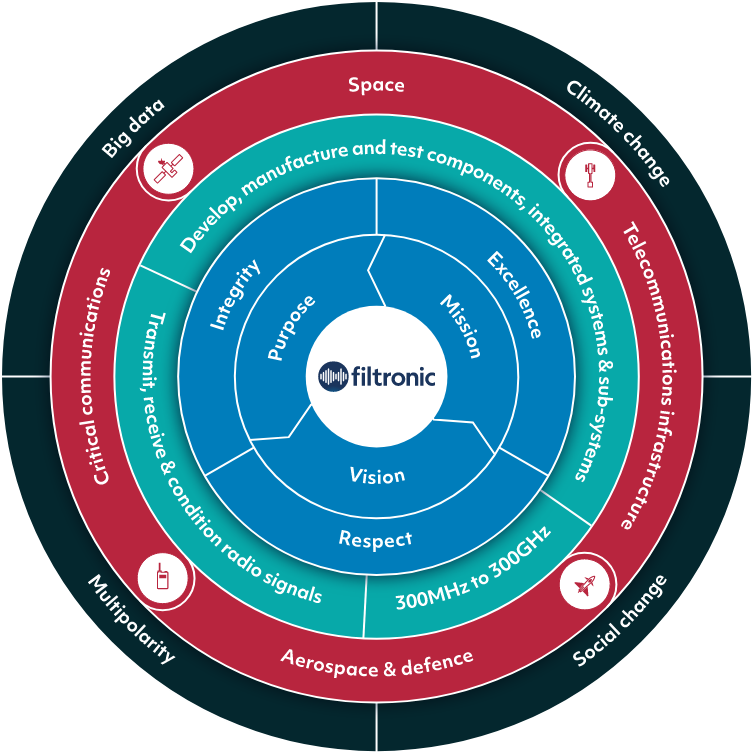

With experience and an innovative culture, we enable creative solutions for highly complex RF challenges. Our products are integral to a range of challenging applications including telecommunications infrastructure, aerospace and defence, space and critical communications. Additionally, our design capabilities are from 300MHz to 300GHz, we can manufacture complex RF products and components up to 115GHz and have market leading test capabilities up to 140GHz.

Filtronic PLC

FTC.L

(-5%)

(-5%)  (-55%)

(-55%)  (+85%)

(+85%)  (-35%)

(-35%)  (+49%)

(+49%) Why invest?

Filtronic has been at the forefront of RF communications for >45 years. We operate from 3 global manufacturing sites, with 2 engineering centres of excellence covering the full RF spectrum. Our product range and wider technology capabilities are supported by our IP and in-house knowledge, and we have an extensive patent portfolio. Our vision is to innovate and push the boundaries of what Is possible with RF, Microwave and mmWave communication, delivering transformative wireless solutions through design and manufacture leadership, connecting everyone everywhere.

Recent operational highlights include:

- Developing our channels to market, strengthening the order book and improving customer engagement.

- Series of recent contract wins each to a different customer, demonstrating the execution of our objective to broaden the customer base.

- Margin improvement from a stronger sales mix leading to stronger adjusted EBITDA.

- Strengthened core engineering and business development functions.

Accelerating speed to market

Reducing whole life costs

Customisation

Competitive advantage through higher performance

What we specialise in:

Mission critical communications

Customised

RF Sub-systems

300MHz to 300GHz design, manufacture

Hybrid

manufacturing

services

Where we operate

Our purpose

To be the trusted provider of innovative RF solutions.

Our vision

Enabling the future of RF, Microwave and mmWave communication.

Our mission

Creating value for our clients through technology leadership

FY23 Annual Report

Filtronic serves several distinct markets with advanced

RF communications equipment, the main applications

being mobile telecommunications infrastructure (“Xhaul”), critical communication networks and aerospace & defence. In addition to these terrestrial applications, we also see increasing opportunity for our technology in stratospheric and low earth orbit (“LEO”) space applications, where we add value through leveraging our existing intellectual property and over 40 years of RF design expertise.